The Federal Government is proposing to borrow ₦17.89 trillion in 2026 to fund the country’s expanding fiscal obligations, according to newly released medium-term budget documents. The move marks one of Nigeria’s largest annual borrowing plans to date and reflects a widening gap between government revenue and expenditure.

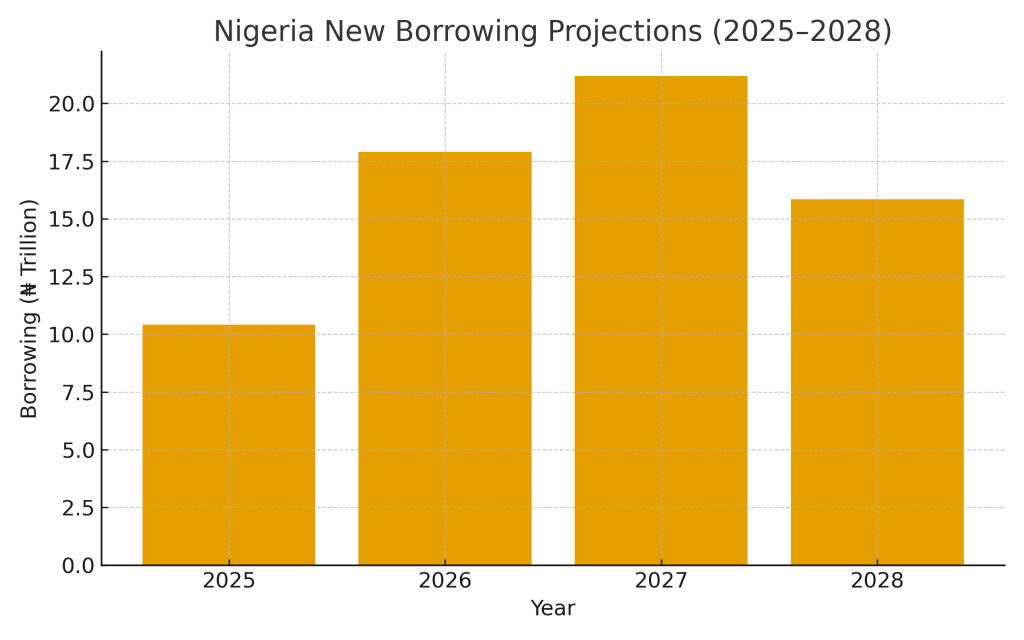

According to projections, the planned borrowing represents a 72 percent increase from the estimated ₦10.42 trillion new loans expected to be secured in 2025. The government’s 2026 fiscal deficit is projected to reach ₦20.12 trillion, up from ₦14.10 trillion in the previous year. Officials attribute the escalation to shrinking revenue expectations alongside rising debt service obligations.

Out of the ₦17.89 trillion expected to be sourced next year, ₦14.31 trillion representing roughly 80 percent will come from the domestic market, while ₦3.58 trillion is slated for external borrowing through multilateral and bilateral lenders. This continues the government’s recent trend of leaning heavily on local debt instruments, partly due to tougher conditions in the global credit market.

The medium-term fiscal framework also reveals that Nigeria plans even larger borrowings in subsequent years. In 2027, new loans may rise to ₦21.18 trillion, before moderating to ₦15.84 trillion in 2028. Cumulatively, the government expects to raise ₦54.91 trillion in new loans between 2026 and 2028.

Nigeria’s total 2026 budget envelope is projected at about ₦54.4 trillion, with a significant portion expected to be consumed by debt servicing. Additionally, authorities have confirmed that 70 percent of the 2025 capital budget will be rolled over into 2026 to ease pressure caused by reduced revenue flows and rising financing needs.

Economists have expressed concern that the rapid increase in domestic borrowing could worsen private-sector credit constraints, elevate interest rates, and further stretch Nigeria’s already fragile debt sustainability metrics. Analysts also caution that Nigeria risks entering a cycle where more borrowing is required simply to service existing obligations.

Despite these concerns, government officials say the new borrowing is necessary to maintain economic stability, sustain key infrastructure spending, and support ongoing fiscal reforms. The National Assembly is expected to debate the proposals as part of the broader 2026 budget process in the coming months.